We all know, “everyone” isn’t a customer segment. But what do you we do when we’ve got a bunch of potential customer segments?

It’s an issue we all face at one point or another, in fact, as we previously noted, Bounce has a pile of potential customers:

We could offer appointment reminders plus Salesforce integration!

We could provide on-time metrics for each employee!

We could make an alarm that lets you sleep in or wakes you up early based on how bad traffic is!

We could gamify punctuality so they’re late less often!

We could offer additional information about sporting events, concerts, etc. that could be causing worse than normal traffic congestion.

If we target all of these customers, not only will it take forever to build this product, it’ll be a complete mess. So which group of customers are our ideal targets?

We could interview 20 of each group, but I think there’s a more efficient way.

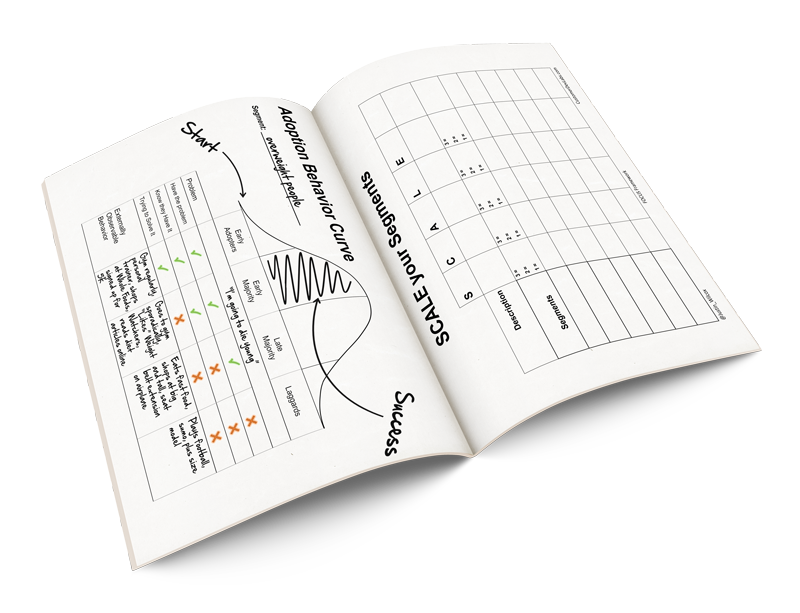

Gut Check Prioritization

Let’s just gut check prioritize the segments we know about:

- First, add each customer group as a column in Excel

- Assign each group a value of 1-3 (1 = low, 3 = high) for the following criteria:

- Market Size – how “many” of this type of customer exist

- Pay for value – how much we think they’ll pay for this value

- Accessibility – how easy is it to find, contact and sell customers in this segment

- Multiply the scores together and sort them from highest score to lowest

- Start testing hypotheses with the highest scoring segment, and work your way down until you’ve got something people are dying to pay you for

Why I love this process

- It’s fast. Takes < 10 minutes.

- It’s okay that we don’t know the real values, we’re going to test our guesses anyway. This is just a way to prioritize our customers so we don’t get stuck in Lean Startup Paralysis, or start building a product that does everything for everyone.

- We don’t need to interview everybody. If our first couple rounds of testing reveal a lot of interest from our top “gut check” customer segments, but in reality “VP of Sales” were the ones most willing to pay for a product, I hypothesize they’ll make themselves known once the product is launched. No need to stress out testing all of our potential revenue sources – find one that meets our minimum success criteria and go with it.

- I was wrong. Before I did this process I had thought initially thought “VPs of Sales”, the “Chronically Late” and “Regular Commuters” would all be ideal customer segments. This quick process hinted otherwise.

What’s Next?

This is Part 1 of our series of on Interviewing Customers:

- Which Customers Should you Interview (The SPA Treatment)

- How to Find Customers to Interview

- Getting Customer Interviews with Cold Emails

- How I Interview Customers

- You’ve Interviewed Customers. Now what?

Join the experiment – follow along via Email or RSS for updates on our next post: Help Investors Believe you – show them Customer Quotes.

Hi Justin, reading more and more of your material and can’t stop saying Thank You mate! I had a quick question about Early Adopters and the Early Majority that you speak about in some of your videos and blog posts.. (wrong blog post to post this comment in perhaps? Sorry if so!). In your experience, are early adopters from the same demographic as the early majority but it’s just that the latter aren’t keen to look for a solution? For example, in your meeting reminder app example from the You Tube videos, will the early majority of Real Estate Agents be the same as the early adopter Real Estate agents (only that the early adopters are looking for a solution now and the early majority will need to get motivation from the early adopters to get a move on) ..or will the early majority turn out to be a completely different customer segment? Hope the question makes sense. (psst.. was just thinking that I should probably make you a mentor if my idea gets anywhere lol)

Great question Karthik. The answer is yes, they are part of the same demographic – what differentiates them is their relationship to the hypothesized problem. EA’s are actively looking for a solution while EM’s recognize they have a problem, but aren’t actively trying to solve it.

Thanks for asking and I hope that helps!

Cheers,

Justin

Nice video. I would suggest we do SPPA. Separate columns to determine ability to PAY, and their PAIN.

Thanks for the suggestion!

Actually SPA has morphed into SCALE (Size, Currency, Access, Love and Early adopters) which better represents the aspects that I think I most important for prioritizing customer segments. For more information about SCALE, check out the FOCUS Framework: How to Find Product-Market Fit.

I think this is a great approach. If someone were to look for something more accurate than a gut feeling, a great place to look for audience size is to create a custom audience in facebook ads (you don’t actually pay for the ad, just play around with audience settings and look for the “estimated reach” on the right hand side.

Justin,

Small question, do you know who is the ‘founder’ of this SPA-Tool? And any ideas where I can find more backgroundinformation about this tool? Many thanks in advance!

Hi Yvonne,

The SPA tool is my creation – born out of working with startups that needed help prioritizing their customer segments.

It’s since evolved from SPA to SCALE:

It’s written up in full detail in the FOCUS Framework (Workbook 1: Exercise 5), and includes a handy spreadsheet to do the prioritization for you/teams.

All the best,

Justin