On the path to your Product Market Fit, not all potential customers are created equal—at least, not at the beginning.

The first group of people you need to win over are your Early Adopters.

In this post, you’ll figure out who your Early Adopters are, but first, we need to get on the same page and answer the question…

What Are Early Adopters?

Many think “Early Adopters” are people who sleep outside of the Apple store before a big launch. People who always have the latest new gadget is one definition of Early Adopter, but that’s not who we’re referring to in the context of entrepreneurship.

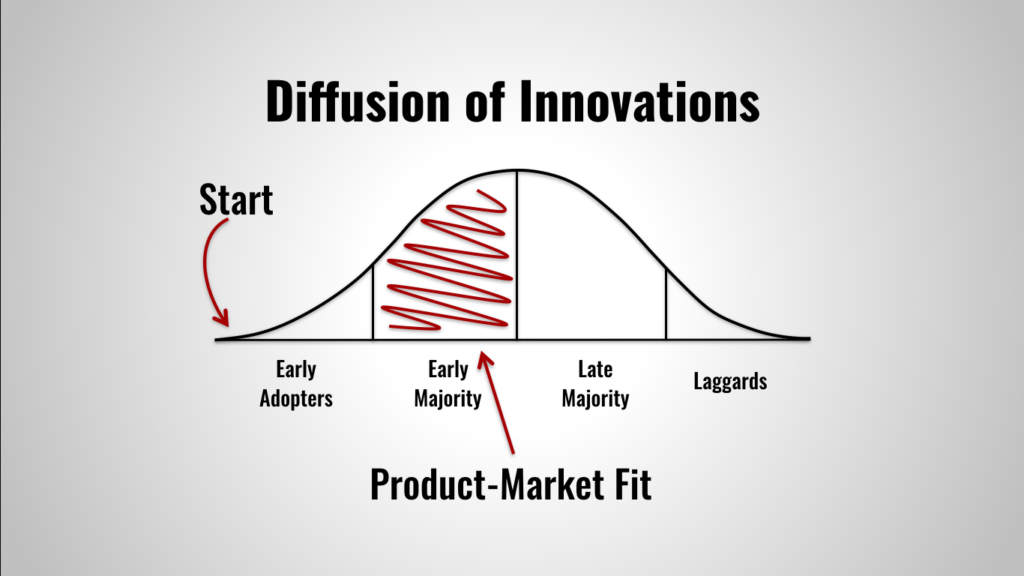

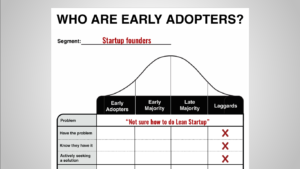

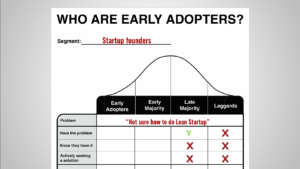

In entrepreneurship, the Early Adopters are the first group of people that buy any new product/service (tech or otherwise). The Early Adopters are followed by the Early Majority, Late Majority, and the Laggards.

The Diffusion of Innovations curve represents the growth of a product over time in terms of customers. Many of you will achieve Product Market Fit once your Early Majority is using your product.

But there’s one thing you have to do before your Early Majority will jump on board…

You have to get your Early Adopters.

Why Do Early Adopters Matter So Much?

Without Early Adopters, there’s no one to tell your Early Majority about your product. If you don’t get your Early Majority, no one will convince your Late Majority to use your product, and of course, you’ll never find your Laggards.

Your entire growth process starts with and depends on your Early Adopters. In fact…

If you can’t find Early Adopters for your product, you won’t find Product Market Fit.

Who Are Your Early Adopters?

To understand who your Early Adopters are, you need to remember something I talk about all the time: customers don’t buy products. Customers buy solutions to problems.

So, the way to tell if someone is an Early Adopter is to assess their relationship to the problem you want to solve.

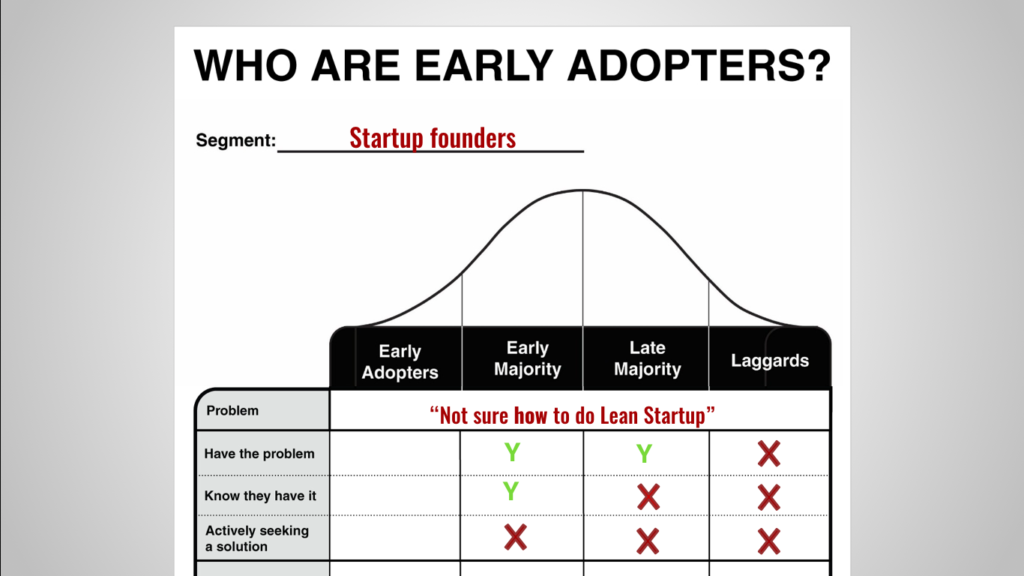

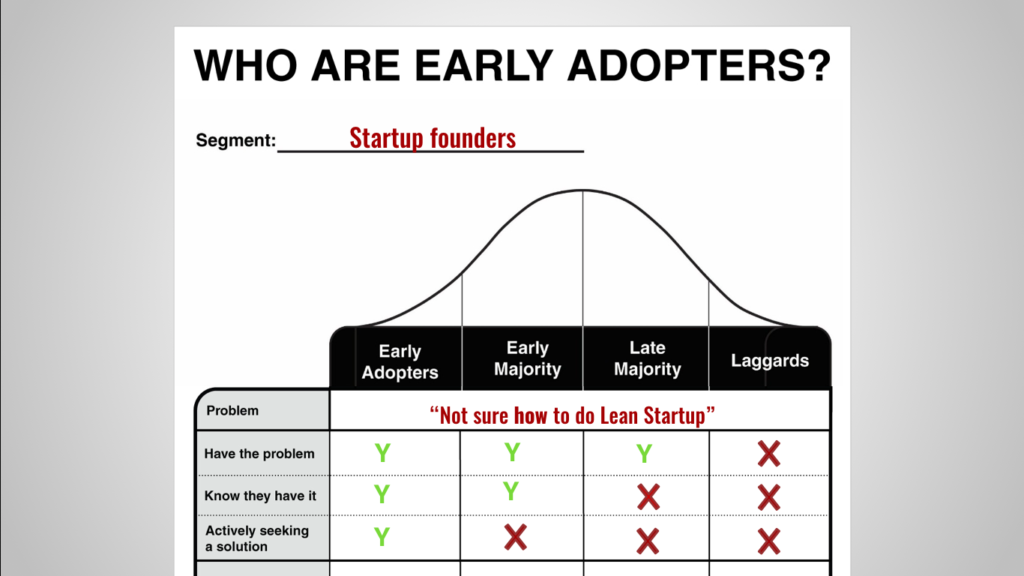

For instance, let’s say the customers you want to serve are startup founders and the problem you want to solve for them is, “I’m not sure how to do Lean Startup.” (They buy into the theory, but they have difficulty applying the principles.)

For instance, let’s say the customers you want to serve are startup founders and the problem you want to solve for them is, “I’m not sure how to do Lean Startup.” (They buy into the theory, but they have difficulty applying the principles.)

I’ll break down each of the groups on the Diffusion of Innovations Curve using this example, so you can see what makes Early Adopters so unique.

Let’s start with the…

Laggards

Laggards are people who fall into your customer segment, but they will be the very last group of people to use your product or service. Why?

Because laggards are people in your segment who literally don’t have the problem you’re trying to solve.

In our startup founder example, our laggards would be startup founders who don’t have problems with their inability to apply Lean Startup—people like…

- Lean Startup experts (e.g. Eric Ries, Ash Maurya, Steve Blank, etc.)

- Startup founders who leverage different methodologies (e.g. Jobs to Be Done, Design Thinking, etc.)

- Startup founders who have no methodology at all (e.g. the “build it and they will come” founders).

You can see, none of the groups listed above would ever say the words, “I’m not sure how to do Lean Startup”, so they’re going to be the last group of people we build a solution for.

Since they don’t have the problem, you can infer that they don’t know they have a problem, and therefore, aren’t actively seeking a solution to it. So, they get X’s down the entire column in the chart above.

Late Majority

The Late Majority are customers who suffer from the problem, but don’t realize it yet (even if you do). You can identify a member of your Late Majority by these characteristics:

For instance, a Late Majority startup founder might call herself “lean” because she has/spends very little money (an incorrect definition of Lean). Alternatively, someone who thinks an ”MVP” is the same thing as a beta version of the product could also be considered a member our Late Majority.

We know these people will have problems applying Lean Startup principles, because they don’t understand them.

If you have to educate your customers about their problems, you’re talking to a member of the Late Majority.

Members of the Late Majority are extremely difficult to sell to because you have to spend a lot of time just to get their attention…only so you can convince them they have a problem!

No one likes to be told they have a problem they don’t see in themselves, so it’s a huge waste of time to try and convince your customers they have a problem that you see and they don’t.

Of course, since they don’t know they have a problem, they aren’t “actively seeking a solution for it.”

Early Majority

The Early Majority is more aware of their problems than the Late Majority. The Early Majority…

The Early Majority is more aware of their problems than the Late Majority. The Early Majority…

- Have the problem you’re trying to sove and

- Know they have the problem, but

- They aren’t actively looking for solutions to it.

Members of your Early Majority are awesome because they’re already convinced they have a problem; they just aren’t actively seeking a solution to it, usually for two reasons:

- The problem isn’t painful enough yet (e.g. a founder who just started reading Lean Startup but hasn’t started to implement it).

- They’ve looked for solutions before but didn’t find anything suitable, so they stopped looking.

This group of customers, along with your Late Majority, will make up the vast majority of your eventual customers. It’s great to know that they are there because…

The Early Majority is often big enough to help you achieve Product Market Fit, but they won’t come onboard until you first have Early Adopters.

Early Adopters

An Early Adopter meets all the following criteria:

An Early Adopter meets all the following criteria:

- They have the problem you’re trying to solve

- They know they have it and

- They are actively seeking solutions to it.

These are the people you want to target first. They’re already looking for a solution, so they are much more likely to take a risk trying out a new product — a product they’ve never heard of, from a company they’ve never heard of — like yours!

In fact, Early Adopters are so excited about solving their problem, they’ll often pre-pay you to build a solution for them. Then, they’ll happily spread the message to other people who have the same problem (i.e your Early Majority).

Think of any successful Kickstarter campaign – they’re supported by hoards of Early Adopters, pre-paying to solve a “problem” (whether physical, emotional, or intellectual), who then share that solution with their friends via Facebook and Twitter. By the way, the same principles apply in B2B scenarios as well (just with less publicly visiblefanfare).

This, my friends, is how you achieve Product Market Fit.

- Find your Early Adopters who are already seeking a solution to a problem.

- Help them solve it.

- Then, they’ll tell your Early Majority about it for you.

Next: Finding Your Early Adopters in Real Life

Now that you know what to look for in an Early Adopter, you can identity them for your startup.

Start by writing down the actions an Early Adopter might make when looking for a solution to their problem.

For instance, if you found this blog by searching for articles on a specific topic, you’re an Early Adopter in our startup founder example because you’re actively seeking a solution for applying Lean Startup principles.

However, if a friend shared this blog with you and you thought, “Interesting, maybe I’ll check it out,” you might be in the Early Majority; you know you have a problem, but maybe you weren’t actively seeking a solution to it.

The bottom line is:

You need to find the people who are actively seeking a solution to the problem you want to solve. These will be your first customers.

Want Help?

If you want detailed guidance finding your Early Adopters, take a look at the Adoption Behavior Curve worksheet. It’s the 4th exercise in the first FOCUS Framework workbook.

With it, you’ll discover exactly:

- Who your Early Adopters are,

- Where you can find them, and

- How to reach out to them.

Now you know the key to identifying your Early Adopters. Look for people who:

- Have the problem,

- Know they have the problem, and

- Are actively seeking a solution for it.

For Part 2 of this series on Early Adopters, check out Early Adopters Part 2: Who you should Interview.

Hi, Justin!

I wanted to come back with a question about how to distinguish who is an early adopter and how to understand how “ACTIVELY” they are searching for a solution. What is the term actively?

I went through the framework 1.4, but I have a problem of distinguishing is this customer an early adopter or not. In customer interviews (I had around 500), I’m trying to find out how actively they are searching for the solution. Some say “wau, this is exactly what I was looking for” => early adopter. Others, “we were looking for some opportunities as we were building the product” = ???. They sort of confirm that they have been looking for a solution, but I doubt that the term “ACTIVELY” is there.

So my question is what actively means, and how to determine if a customer is looking for solution actively or passively?

Thank you for your help!

Andris Merkulovs

Founder of TheMonetizr.com

Thanks for the question Andris, it’s a great one.

To me, someone is actively trying to solve the problem if they’ve sought out a solution in the last 6 months. You can adjust that definition as you see fit.

Justin

Hi Justin.

I’ve learned a ton from you and appreciate all your expertise. However, I think you may be wrong above in describing Laggards as literally not having the problem – according to Everette Rogers’ Diffusion of Innovation, while they are extremely conservative, slow-moving and change-averse, they do actually have the problem (even if they don’t know or believe they do). This Wikipedia post gave me a quick overview: https://en.wikipedia.org/wiki/Diffusion_of_innovations Thank you.

Thanks for the comment Mark!

You’re absolutely right, my definitions of these classifications are not identical to the definitions of Rogers, Moore or Blank.

That’s because the definitions I find most helpful are ones that help me find members of these classifications. Where as the classical theoretical definitions sound great, I haven’t gotten much mileage using them to actually find early adopters.

In fact, with many of these traditional definitions it can be easy to fall into the trap of treating these classifications as if they are personality types. You could assume that someone who is “extremely conservative, slow-moving and change-averse” would be a laggard for all innovative products which, in my experience, isn’t the case. People may be change-averse in one area of their life, but change agents in another. The way I tell the difference is to I assess their relationship to the problem I’m trying to solve.

If you find the traditional definitions more useful in building your business, by all means, use them. Fwiw, the definitions above have served me well in terms of actually finding my Early Adopters.

Thanks again for bringing this up!

Justin